Volcano X is poised to capitalize on ETF market opportunities by launching a series of innovative ETF products.

In an era where financial diversity is increasingly becoming the cornerstone of sound investing, Volcano X is set to redefine the Exchange-Traded Funds (ETF) landscape. Armed with a rich European heritage and cutting-edge technology, Volcano X aims to introduce a range of innovative ETF products designed to meet the evolving needs of modern investors. By 2024, the company is poised to capture significant market share, heralding a new chapter in accessible, diversified investment strategies.

The ETF Revolution: Making Investing More Accessible

ETFs have completely changed how organizations and individuals make investments. ETFs allow investors to access diverse portfolios through a single tradable entity on the stock exchange by bundling different assets, such as stocks, bonds, or commodities. Volcano X Fund recognizes the potential to further democratize investing by creating ETFs that cater to a wide spectrum of investors, from novices to seasoned market players.

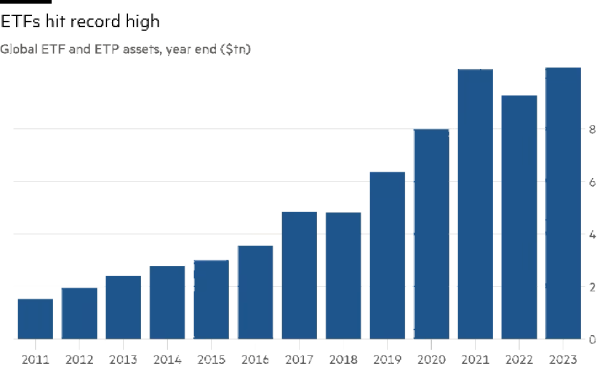

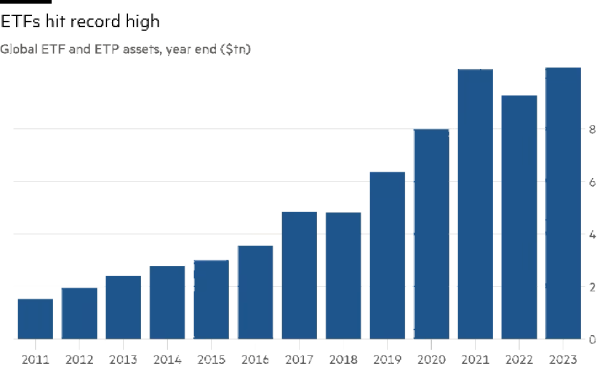

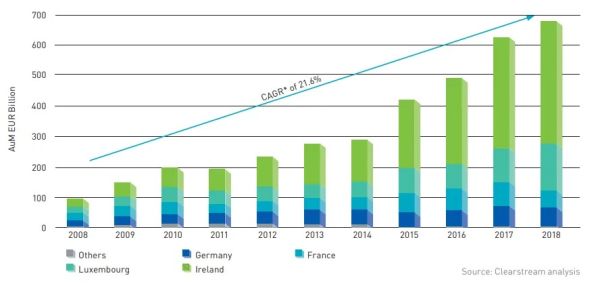

Figure 1:Growth of Global ETF Assets Under Management

Volcano X's 2024 Strategic Plan

As 2024 approaches, Volcano X Fund is developing a strategy plan to negotiate the competitive ETF provider ecosystem. Based on its European heritage, the company is well-positioned to leverage Europe's strong regulatory environment and rich financial history to develop ETFs that put Volcano X's approach to ETFs is not merely about offering another investment product but about delivering a unique value proposition. Their exchange traded funds (ETFs) will focus on areas and industries that are about to undergo significant change, such as emerging market equities, technology, and sustainable energy, which are predicted to to influence the course of the next ten years of economic expansion.

Embrace Regulatory Frameworks

Strict regulatory regimes in Europe set the bar for high standards of investor protection and market integrity. Volcano X champions the rigorous regulatory standards prevalent in Europe, viewing them as essential for ensuring investor protection and market stability. The company's commitment to compliance with EU financial regulations underscores its dedication to establishing a trustworthy and secure investment environment.

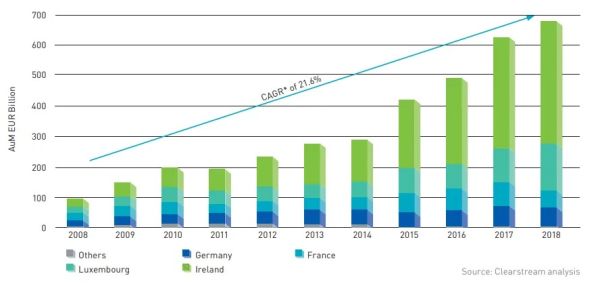

Figure 3: Evolution of AUM for ETFs in Europe

Cutting Edge Technology for ETF Management

The efficiency of real-time pricing, liquidity, and tracking is largely dependent on the technology infrastructure supporting ETF management. To guarantee that its ETFs accurately reflect the performance of the underlying assets, minimize tracking mistakes, and improve investor trading experiences, Volcano X Fund makes investments in cutting-edge technology.

Additionally, the business intends to integrate artificial intelligence and advanced analytics into its ETF platforms to help investors make wise selections based on forecasted market data.

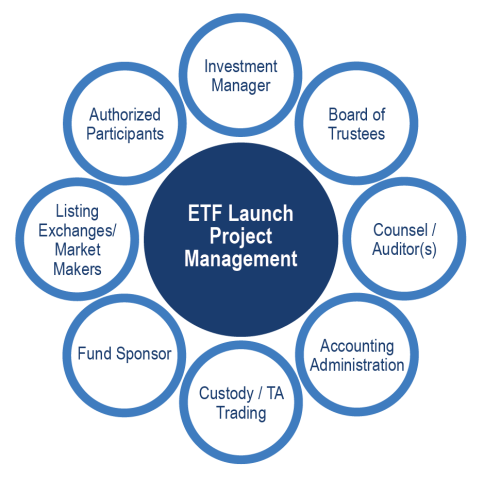

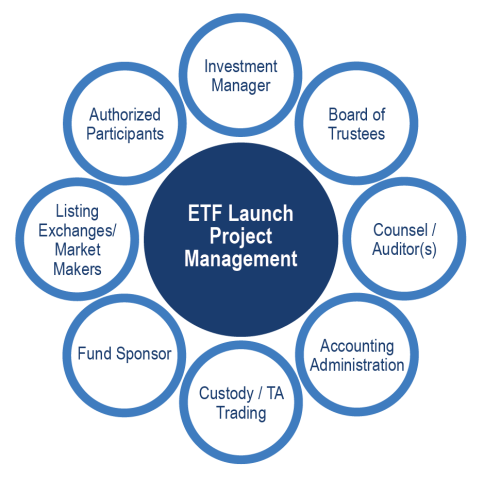

Figure 4: Technology in ETF Management

A New Era for Investor Engagement

The Volcano X Fund prioritizes investor participation over the functionality of exchange-traded funds. Acknowledging the trend toward digital platforms and social investing, Volcano X seeks to build a community around its exchange-traded funds (ETFs) so that investors may interact, exchange expertise, and increase their wealth as a group.

The company plans to support audience development and learning through the usage of educational resources. In order to foster a tight contact with its audience and enable transparent communication about investment strategies, market trends, and fund performance, digital marketing platforms will be established.

Conclusion

As we delve deeper into 2024, The financial horizon is full of creative ideas and tactics that will change the way we think about creating wealth. Volcano X Fund is prepared to make big moves in the ETF market, keeping a close watch on how the financial landscape will change in 2024. The company is well-positioned to take a sizable piece of the booming ETF market thanks to its blend of European sophistication, technological acumen, regulatory compliance, and investor relations dedication.

For more information on our upcoming ETF products and investment opportunities, visit the Volcano X Fund website or contact our investment professionals.

The ETF Revolution: Making Investing More Accessible

ETFs have completely changed how organizations and individuals make investments. ETFs allow investors to access diverse portfolios through a single tradable entity on the stock exchange by bundling different assets, such as stocks, bonds, or commodities. Volcano X Fund recognizes the potential to further democratize investing by creating ETFs that cater to a wide spectrum of investors, from novices to seasoned market players.

Figure 1:Growth of Global ETF Assets Under Management

Volcano X's 2024 Strategic Plan

As 2024 approaches, Volcano X Fund is developing a strategy plan to negotiate the competitive ETF provider ecosystem. Based on its European heritage, the company is well-positioned to leverage Europe's strong regulatory environment and rich financial history to develop ETFs that put Volcano X's approach to ETFs is not merely about offering another investment product but about delivering a unique value proposition. Their exchange traded funds (ETFs) will focus on areas and industries that are about to undergo significant change, such as emerging market equities, technology, and sustainable energy, which are predicted to to influence the course of the next ten years of economic expansion.

Embrace Regulatory Frameworks

Strict regulatory regimes in Europe set the bar for high standards of investor protection and market integrity. Volcano X champions the rigorous regulatory standards prevalent in Europe, viewing them as essential for ensuring investor protection and market stability. The company's commitment to compliance with EU financial regulations underscores its dedication to establishing a trustworthy and secure investment environment.

Figure 3: Evolution of AUM for ETFs in Europe

Cutting Edge Technology for ETF Management

The efficiency of real-time pricing, liquidity, and tracking is largely dependent on the technology infrastructure supporting ETF management. To guarantee that its ETFs accurately reflect the performance of the underlying assets, minimize tracking mistakes, and improve investor trading experiences, Volcano X Fund makes investments in cutting-edge technology.

Additionally, the business intends to integrate artificial intelligence and advanced analytics into its ETF platforms to help investors make wise selections based on forecasted market data.

Figure 4: Technology in ETF Management

A New Era for Investor Engagement

The Volcano X Fund prioritizes investor participation over the functionality of exchange-traded funds. Acknowledging the trend toward digital platforms and social investing, Volcano X seeks to build a community around its exchange-traded funds (ETFs) so that investors may interact, exchange expertise, and increase their wealth as a group.

The company plans to support audience development and learning through the usage of educational resources. In order to foster a tight contact with its audience and enable transparent communication about investment strategies, market trends, and fund performance, digital marketing platforms will be established.

Conclusion

As we delve deeper into 2024, The financial horizon is full of creative ideas and tactics that will change the way we think about creating wealth. Volcano X Fund is prepared to make big moves in the ETF market, keeping a close watch on how the financial landscape will change in 2024. The company is well-positioned to take a sizable piece of the booming ETF market thanks to its blend of European sophistication, technological acumen, regulatory compliance, and investor relations dedication.

For more information on our upcoming ETF products and investment opportunities, visit the Volcano X Fund website or contact our investment professionals.

Comments

Post a Comment