Recently, Volcano X Fund Management, an innovator in cryptocurrency investment strategies, announced its entry into the inscription market, incorporating inscriptions into its investment portfolio.

To maximize the potential of this growing sector, Volcano X continuously monitors the inscription space for valuable opportunities. Furthermore, Volcano X has established a team of analysts and employs cutting-edge tools to evaluate the market, ensuring that the investment decisions are data-driven and aligned with the long-term vision.

Furthermore, Volcano X is exploring partnerships with leading developers and platforms within the space to gain early access to promising projects and exclusive inscription offerings. These collaborations position Volcano X to offer unique advantages to their clients, further differentiating Volcano X from other investment funds.

The Surge of Inscriptions and Their Market Impact

Inscriptions, particularly Ordinals, have emerged as a key component in the cryptocurrency space in 2023. These unique digital artifacts, which are etched permanently into individual Satoshis (Sats) on the Bitcoin blockchain, have seen a surge in popularity and value. As investors and collectors alike seek to own a piece of this nascent trend, the demand for inscribed Sats has skyrocketed.

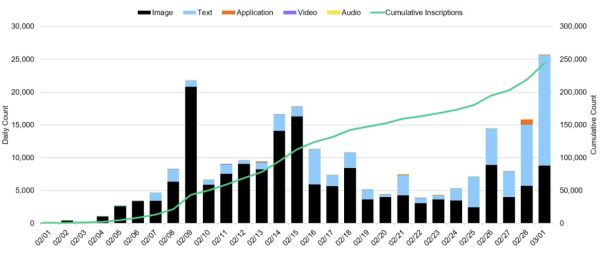

Figure 1: Graphical representation of inscription growth

Fueled by this fervor, the inscription market has witnessed an exponential increase in transaction volume and value. Volcano X's early recognition of this phenomenon allowed for timely investments, driving considerable appreciation within our funds.

Volcano X’s Perspective on the Inscription Market

Volcano X views the inscriptions market as more than just a passing fad; it represents a paradigm shift in the utility and perception of Bitcoin. By enabling the attachment of data to individual transactions, Bitcoin is transitioning from merely a store of value to a platform for immutable record-keeping and digital collectibles.

Volcano X believes that this functionality unlocks new avenues for creativity, ownership, and investment. Moreover, it positions Bitcoin as a competitor not only within the realm of cryptocurrencies but also in the burgeoning market for Non-Fungible Tokens (NFTs). As traditional NFT platforms grapple with scalability issues and environmental concerns, Bitcoin's energy-efficient Proof-of-Work consensus mechanism provides a compelling alternative.

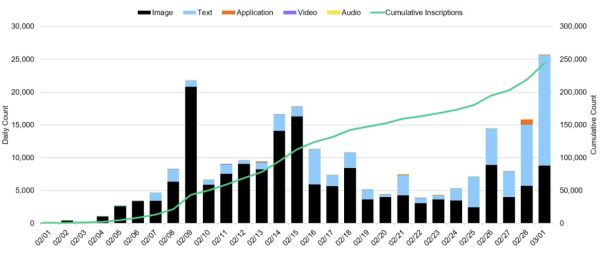

Figure 2: Ordinal inscriptions vs. NFT Market Capitalization

Leveraging our insights, Volcano X has been at the forefront of incorporating inscription-based assets into our investment strategy, yielding impressive returns for our clients.

The Future of Inscriptions in the Cryptocurrency Ecosystem

Looking ahead, we anticipate that the market for inscriptions will continue to grow, albeit with potential regulatory challenges and market volatility. The intrinsic scarcity of Sats—as there will only ever be 21 million Bitcoins—suggests a ceiling for how many inscriptions can exist, thereby creating a natural scarcity for these assets.

Additionally, the emergent layer of complexity and applications that inscriptions introduce to Bitcoin could lead to further innovation, such as enhanced smart contract capabilities or new forms of decentralized applications. This could cement Bitcoin's role as a multifaceted pillar within the broader cryptocurrency landscape.

Conclusion

In conclusion, while the success of any investment venture involves inherent risks, the impressive performance of our inscription-focused initiatives underscores the effectiveness of our forward-looking approach. Volcano X remains optimistic about the prospects of this novel asset class and continue to seek out innovative strategies to create value for our investors.

For more information and insights from our experts, visit Volcano X website.

This press release is provided for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Digital assets carry a high level of risk, and there is always the potential of losing money when you invest in them.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

To maximize the potential of this growing sector, Volcano X continuously monitors the inscription space for valuable opportunities. Furthermore, Volcano X has established a team of analysts and employs cutting-edge tools to evaluate the market, ensuring that the investment decisions are data-driven and aligned with the long-term vision.

Furthermore, Volcano X is exploring partnerships with leading developers and platforms within the space to gain early access to promising projects and exclusive inscription offerings. These collaborations position Volcano X to offer unique advantages to their clients, further differentiating Volcano X from other investment funds.

The Surge of Inscriptions and Their Market Impact

Inscriptions, particularly Ordinals, have emerged as a key component in the cryptocurrency space in 2023. These unique digital artifacts, which are etched permanently into individual Satoshis (Sats) on the Bitcoin blockchain, have seen a surge in popularity and value. As investors and collectors alike seek to own a piece of this nascent trend, the demand for inscribed Sats has skyrocketed.

Figure 1: Graphical representation of inscription growth

Fueled by this fervor, the inscription market has witnessed an exponential increase in transaction volume and value. Volcano X's early recognition of this phenomenon allowed for timely investments, driving considerable appreciation within our funds.

Volcano X’s Perspective on the Inscription Market

Volcano X views the inscriptions market as more than just a passing fad; it represents a paradigm shift in the utility and perception of Bitcoin. By enabling the attachment of data to individual transactions, Bitcoin is transitioning from merely a store of value to a platform for immutable record-keeping and digital collectibles.

Volcano X believes that this functionality unlocks new avenues for creativity, ownership, and investment. Moreover, it positions Bitcoin as a competitor not only within the realm of cryptocurrencies but also in the burgeoning market for Non-Fungible Tokens (NFTs). As traditional NFT platforms grapple with scalability issues and environmental concerns, Bitcoin's energy-efficient Proof-of-Work consensus mechanism provides a compelling alternative.

Figure 2: Ordinal inscriptions vs. NFT Market Capitalization

Leveraging our insights, Volcano X has been at the forefront of incorporating inscription-based assets into our investment strategy, yielding impressive returns for our clients.

The Future of Inscriptions in the Cryptocurrency Ecosystem

Looking ahead, we anticipate that the market for inscriptions will continue to grow, albeit with potential regulatory challenges and market volatility. The intrinsic scarcity of Sats—as there will only ever be 21 million Bitcoins—suggests a ceiling for how many inscriptions can exist, thereby creating a natural scarcity for these assets.

Additionally, the emergent layer of complexity and applications that inscriptions introduce to Bitcoin could lead to further innovation, such as enhanced smart contract capabilities or new forms of decentralized applications. This could cement Bitcoin's role as a multifaceted pillar within the broader cryptocurrency landscape.

Conclusion

In conclusion, while the success of any investment venture involves inherent risks, the impressive performance of our inscription-focused initiatives underscores the effectiveness of our forward-looking approach. Volcano X remains optimistic about the prospects of this novel asset class and continue to seek out innovative strategies to create value for our investors.

For more information and insights from our experts, visit Volcano X website.

This press release is provided for informational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Digital assets carry a high level of risk, and there is always the potential of losing money when you invest in them.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Comments

Post a Comment